Context

Execution

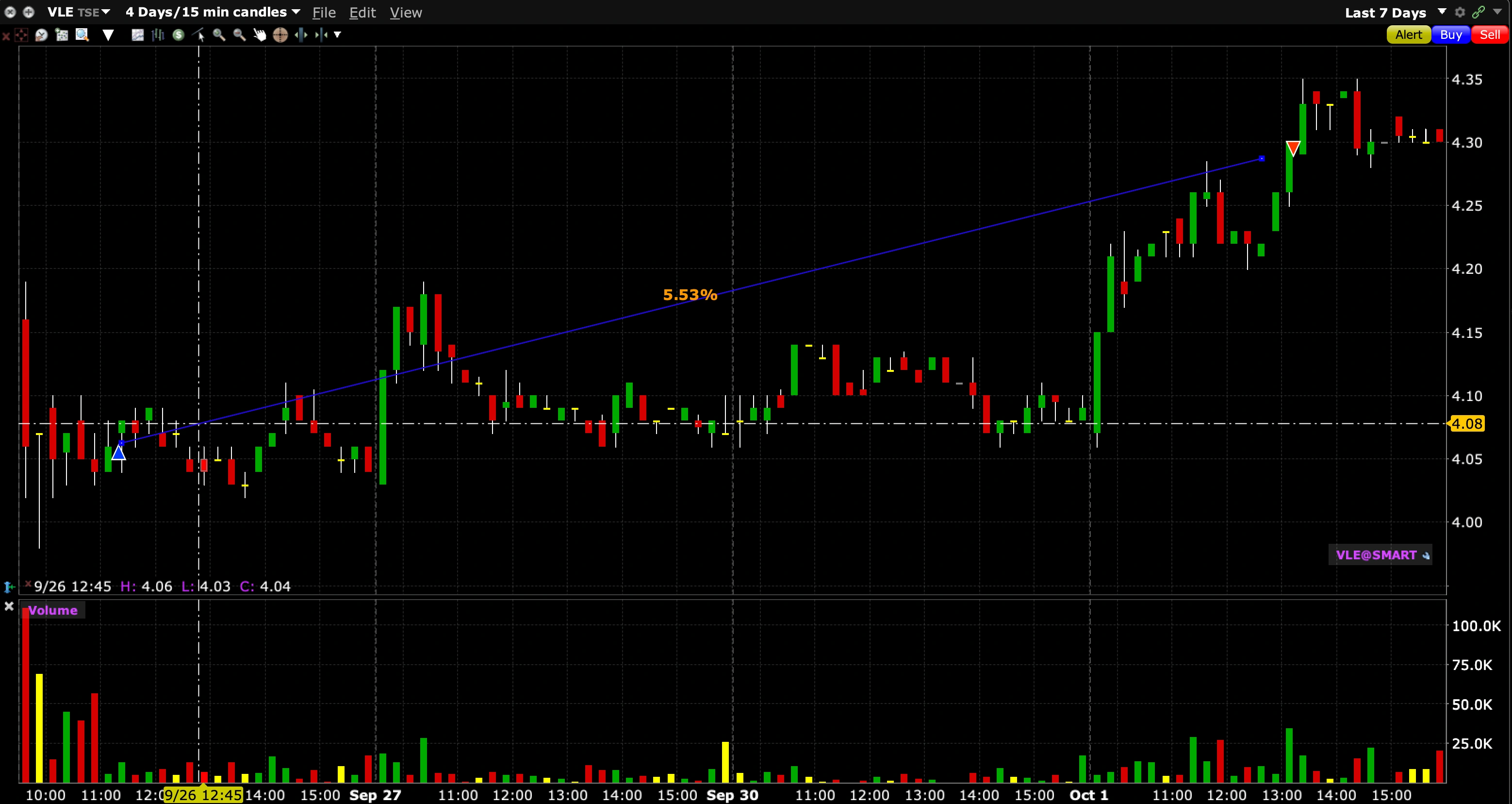

$VLE.TO 6d trade

5.17% net return in 6 days.

Optimal entry point was 2.2% lower at 9:45am. Should have increased position when it tested $4.04 later.

Optimal exit point was 1.29% higher. I could have safely got closer to it because there was strong volume.

Why did the trade work? Chance: Iran attacking Israel drove oil prices up ~4.7%. Without it, oil prices would probably have tended lower on subdued economic activity.

Other observations? With the commisions on $VLE.TO, the low liquidity of the name, the unpredictability of oil prices, and the fact that this is also a core position, not worth playing trades unless there’s a new oil slump.

Lessons learned I could have realistically made +47% on this trade (5.17 + .9 + 1.29 = 7.36 / 5.17) if I had:

- (entry) bought at an inflection point later in the day when I had more data

- (exit) waited for breakout to consolidate, volume bars were clear

$VOO Intra-day

0.25% return in 30min.

The chart shows the position I’ve bought recently, a total mess. I consciously tried not to let that affect me, and considered the intra-day trade completely independent.

Entry point: good job, bought during inflection point. I saw the large volume, but I also saw that the candle was thinner so I saw a resistance.

Exit point: suboptimal, missed 0.38% of gains. Why? I thought there was a resistance at $523 because of the previous movements ignoring volume bars.

Lessons learned Look at the volume bars. I could have realistically made +150% returns on this.

$MSFT 1-3(?)d trade

Took a look based on a reference from SMB Capital.

Incomplete trade, I expected this to take 1-3d when I entered but already important lessons learned:

Entry point: all but the last entry points were ill-timed and preventable. What I did wrong:

- I bought during pre-market. I’ve already heard people with years of experience trading saying that they normally buy after 10am or 10.30am because the period of price discovery before that is noise. I did the complete opposite: bought most of the position before 10.30am.

- During pre-market there is no volume. Buying for swing or day trading is meaningless during that time.

- I entered without a plan for “What if I’m wrong?” I could have stop lossed by $427.50 when reality was so different from my expectation. If I had done that, I would have had powder for the rest of the day.

- Instead of exiting, I continued buying and stopped 0.58% away from the day’s low. The purchase at 10:55 was okeish, but could have realistically be improved by waiting because volume during that consolidation was thinner than before.

The last entry point was acceptable. I expect it to turn out well. There does seem to be a support.

Exit points:

- The exit point was ok. Given the previous one, I could have easily waited a bit to increase +0.10% absolute return.

Observations: This and $MU moved mostly with $VOO. If I’m confident about what I’m doing and macro is moving the markets, they present an opportunity to benefit from higher volatility.

$MU 1-3(?)d trade

I also expected this play to take 1-3d to play out.

Same general observations as for $MSFT. Bought during pre-market, although less because I consider it more expensive. But still I was too impatient buying and bought most of the position during price discovery and I had no stop loss, so now I’m looking at a ~1.4% loss or stuck for, likely, several days.

Exit points: I barely made any profits on the swing trade near EOD. Given the day’s behavior, I think I should have waited a bit longer before assuming inflection point when I sold. I could have easily added 0.26 to 0.38% to an otherwise negligible trade.

What’s got me excited, though is the potential:

The lines represent ~0.78%, 1.35%, 1.69%, 0.72% = 4.54% that I think, had I waited until after price discovery, I could have caught at least 50% of that.

Lessons learned:

- Wait until 10 - 10.30am before making day trading decisions.

FDX 1-3(?)d trade

Got this idea from “Which stocks will benefit from the docks strike?” I chose FDX instead of UPS because FDX reported results recently and it got slammed with poorer outlook. I assumed mean reversion + docks strike would make for an easy win.

I made the same mistakes as with $MSFT and $MU. I then realized it was mostly moving with the market, but with less volatility than $MU and $MSFT, and I felt less confident about this name in the first place, so I left it alone.

Lessons learned:

- Estimating the impact of a strike like this is hard, don’t add to that uncertainty by buying during an uncertain period.

Final observations

Psychology is more important than trade mechanics, don’t panic: Having a tight ass during the whole market is an indicator that my mind isn’t where it needs to be. Meditate more, continue reading the book about Psychology of trading. And, more importantly, have a plan. You know you feel in control and you stand on higher ground when you plan.

At the micro level I expect the Israel and Iran situation to not escalate further, too many vested interests in a certain level of peace, and I don’t expect bad economic results for the rest of the week given the mixed numbers we’ve getting recently. Therefore I expect the 3 new names, $MSFT, $MU, $FDX to recover within one week. MSFT announces earnings ~ Oct 22, and $MU and $FDX already announced theirs recently.

At a macro level, meditate more and keep things in perspective. Day trading gives you a myopic view of a company. We’re nearing all time highs for indices, $MSFT and $MU have too much inertia, and $FDX, despite my shallow understanding of the business, doesn’t look some of the names I’ve been dealing with in microcap land. None of them are likely to drop 50-70%.

Have a plan and be specially aware of your loss aversion: set stop losses. This could have mitigated the mistakes I made early in the session.

Stay just outside of your comfort zone, not 2km away from it: Limit yourself to 1-2 names per day like I’ve been doing in the past 2-3 weeks. You’ve just been doing this for <1 month and you’re flying by the seat of your pants. Trying to make money on ~5 names is a recipe for bad results. Set stop losses and exit strategies for all new BUYs. Keep current positions and practice paper trading until they get freed.

Don’t seek higher returns on individual stocks unless you have a track record of good results. September was good, but it was the first month. Do what you did then, stick to $VOO and $VYM. Expand responsibly.